When evaluating capital projects in the chemical process industries (CPI), there are many scenarios in which there are important differences between the alternatives in terms of capital, operations and maintenance and decommissioning costs. In these cases, decisions must be made based not solely on the initial cost of an investment, but rather the investment throughout its entire useful life. Lifecycle cost analysis (LCCA) is a tool that can be used to aid decision-making in these cases. This one-page reference provides a brief review of the basic concepts of the LCCA methodology.

LCCA basics

LCCA aims to compare different capital-project alternatives on a common basis: total levelized cost, which sums initial and future project costs, adjusted to take into consideration the time value of money. This method can be applied to chemical process facilities to analyze either the entire process, sections of the process, or its unit operations individually.

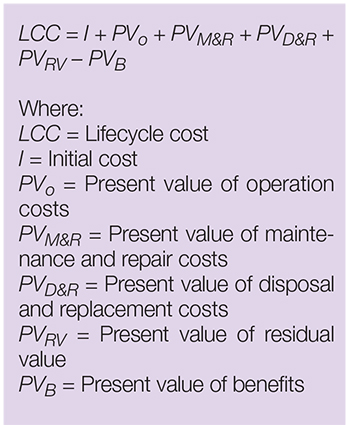

Several factors are taken into consideration when developing an LCCA, including the following: quantifying the present value of initial costs, operating costs, maintenance and repair costs, disposal and replacement costs, residual value and any benefits associated with each alternative. A general formula for LCC, along with the definitions for its constituent terms terms, can be found in the shaded box.

Components of LCC

The components of the LCC equation are further explained below:

Present value. Present value is defined as the time-equivalent value of all cashflows from the start of the project. As the general cost of the project is affected by costs incurred at project start (or the base year), and future costs (any year after the start of the project) these expenses have to be levelized. Future costs are any costs incurred at any time between year one and the study period. They include recurring and one-time costs, affected by the discount rate.

Initial cost. The initial cost includes all capital investments to be made until the project is operational. This includes direct costs, such as equipment, materials, buildings and construction work, as well as indirect costs, such as lease, studies, permits, engineering, project management, taxes and overhead.

Operation cost. Operation costs include all the annual costs required to run the facility, excluding maintenance and repair costs. These include raw materials, utilities (water, electricity, gas and so on), operational labor and services, and indirect costs (such as lease, insurance, security, royalties, overhead).

Maintenance and repair cost. Maintenance and repair costs deal with the upkeep of the project itself and take into consideration that some of these costs can be annual or scheduled at several-year intervals into the future. Mechanical, instrumentation and electrical engineers may provide information regarding the maintenance requirements and frequency of the equipment involved in the project, while civil engineers may provide information about maintenance requirements for building, foundation and structural components; cost engineers then need to estimate rates and work hours for the required maintenance tasks. There is also a risk factor to account for non-scheduled repairs that depends on failure rates of pieces of equipment.

Downtime costs (for example, loss of production, penalties and so on) due to maintenance and repairs may also be considered, if found to be significantly different between the evaluated alternatives.

Disposal and replacement costs.Disposal costs deal with the removal of existing structures or nature on site along with the transportation of wastes generated by construction or demolition (debris, residues and so on). More important, however, are the replacement costs. Every component of a project has a useful life, and the replacement costs are generated by removing and replacing components of the project that have completed their useful lives.

Residual value. The residual value includes costs associated with the project after the study period is over. These values may be positive, negative, or zero. If the values are positive, it means that there are disposal costs attached to the end of the project (for instance, remediation costs), whereas negative values mean there is value linked to the facility at the end of the study period (for example, the plant has a useful life that exceeds the study period) and a zero value indicates no value associated at the end of the study.

Benefits. Benefits include any other value gained by the project throughout the project life. Only benefits that can be transduced into monetary value can be included in the LCCA. For instance, the value of emissions-reduction certificates or tax incentives received from implementing one design alternative would be taken into consideration.

Editor’s note: This month’s “Facts at your Fingertips” column was adapted from the following article: Giardinella, S., Baumeister, Z. and Baumeister, A. Using Lifecycle Cost Analysis for Best Project Value, Chem. Eng., December 1, 2020, pp. 32–39.